Table of Contents

Key Takeaways

- Understanding a Family Asset Protection Trust is crucial for safeguarding your family’s financial future.

- Establishing a trust can offer tax benefits and protect your assets from unexpected costs or changes.

- Step-by-step guidance can simplify the process of setting up your own trust.

- Being aware of the risks, such as deliberate deprivation of assets, helps in making informed decisions.

- Seeking professional advice is recommended to ensure compliance with UK laws and regulations.

When you’re thinking about the future and how best to protect your family’s financial security, the concept of a Family Asset Protection Trust should be on your radar. It’s a powerful tool in your care planning arsenal, one that can offer peace of mind knowing that your assets are safeguarded for the people you care about most.

But why should you consider setting up such a trust? Well, it’s all about preparation and foresight. In life, unexpected events can have significant financial implications for your family. A trust ensures that your assets are managed according to your wishes, even when you’re not around to oversee them. Plus, it can offer tax efficiencies and potentially reduce the burden of inheritance tax on your loved ones.

Why Every UK Family Should Consider a Family Asset Protection Trust

Let’s get to the heart of the matter. A Family Asset Protection Trust isn’t just for the wealthy; it’s a strategic move for anyone who wants to secure their family’s financial wellbeing. The trust acts as a legal entity that holds and manages your assets – this could include property, investments, and cash – for the benefit of your family.

- Protection from future financial risks and uncertainties

- Potential reduction in inheritance tax liabilities

- Control over the distribution of your assets after your passing

The trust is a proactive way to address potential challenges that your family might face, such as long-term care costs or claims on your estate. By placing assets into a trust, you’re not just thinking about today, but also planning for tomorrow.

What a Family Asset Protection Trust Can Do for You

A Family Asset Protection Trust is more than a safety net; it’s a strategic planning tool that can be tailored to your family’s unique needs and circumstances. It allows you to:

- Specify beneficiaries: Clearly define who benefits from your assets.

- Set terms for asset distribution: Decide when and how your beneficiaries receive their inheritance.

- Provide asset protection: Shield your assets from potential future claims, such as divorce settlements or creditors.

Imagine this scenario: you’ve worked hard all your life to build a nest egg, and you want to ensure that it’s passed on to your children. A trust can make that happen smoothly, without the delays and public scrutiny that come with probate.

The Impact on Your Care Planning Journey

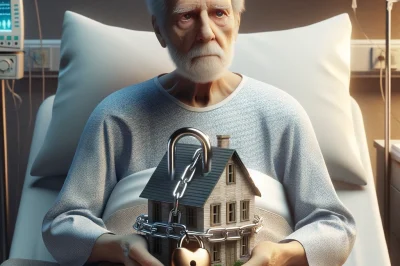

Most importantly, a trust can have a profound impact on your care planning journey. As we age, the possibility of requiring long-term care becomes more likely. The costs associated with such care can be substantial, and without proper planning, could deplete the assets you hoped to pass on to your family.

With a trust in place, you have the means to potentially limit the depletion of your assets to cover care costs, ensuring that your legacy remains intact for your loved ones. It’s a way of ring-fencing what you’ve worked hard for, making sure it serves the purpose you intended.

Deciphering the Family Asset Protection Trust

So, what exactly is a Family Asset Protection Trust? It’s a legal structure where a ‘trustee’ – which could be a family member, friend, or professional – is given the responsibility to manage the assets for the ‘beneficiaries’ – the people you want to benefit from your estate.

Let’s break it down further:

The Anatomy of the Trust

The trust is made up of three key roles:

- The Settlor: That’s you – the person who creates the trust and transfers assets into it.

- The Trustees: They are responsible for managing the trust and carrying out your wishes.

- The Beneficiaries: These are the people who will benefit from the trust, usually your family members.

When you set up a trust, you’re creating a legal agreement that dictates how your assets should be handled now and in the future. It’s like writing a letter to the future, ensuring that your family’s financial needs are met according to your plan.

Setting Up the Trust: A Step-By-Step Guide

Setting up a Family Asset Protection Trust isn’t as daunting as it might seem. Here’s a simplified step-by-step guide to get you started:

- Identify your assets: Take stock of what you own – property, savings, investments, etc.

- Choose your trustees: Decide who you trust to manage your assets. This can be one or more individuals or a professional entity.

- Select your beneficiaries: Clearly define who will benefit from the trust, such as your children or grandchildren.

- Seek professional advice: Consult with a solicitor or financial advisor who specialises in trust and estate planning to help draft the trust deed.

- Formalise the trust deed: This document outlines the terms of the trust and must be signed by all parties involved.

- Transfer assets into the trust: Legally move your assets into the trust’s name.

- Register the trust if necessary: Depending on the type of trust and the assets involved, you may need to register it with HM Revenue and Customs.

Remember, setting up a trust is a significant financial decision, and it’s crucial to get it right. Therefore, seeking professional advice is not just recommended, it’s a vital step in the process.

Maximising the Benefits of Your Trust

Once your Family Asset Protection Trust is established, it’s not just about having it sit there. You need to make sure you’re squeezing every bit of value out of it. It’s like having a powerful car but never taking it out of the garage. Let’s explore how you can do just that.

Protecting Your Family’s Future Financially

One of the most significant advantages of a trust is the financial protection it provides for your family. It’s like building a financial fortress around your assets, shielding them from potential threats. For example, if you have a property in the trust, it’s protected from certain types of creditors and can’t be seized in the event of bankruptcy. Additionally, should you face the unfortunate event of a divorce, assets in a trust are typically seen as separate from the marital pot, providing an extra layer of protection.

But remember, the trust must be set up correctly and operated in a way that aligns with its purpose to ensure these protections are in place. It’s not a ‘set and forget’ situation; you need to manage it actively with your trustees to maximize its benefits.

Navigating Taxes and Inheritance Laws

Taxes can take a significant bite out of your estate if not managed properly. Here’s where your trust comes into play. By holding assets within a trust, you might reduce inheritance tax liabilities, as the trust’s assets typically aren’t counted as part of your estate upon death. This means more of what you’ve worked for goes directly to your loved ones.

However, tax laws are complex and ever-changing. Therefore, it’s crucial to work with a tax advisor who can help navigate these waters and keep your trust compliant with current laws. They’ll ensure that you’re taking advantage of all available tax benefits while steering clear of any pitfalls.

Practical Steps to Get Started Now

If you’re convinced that a Family Asset Protection Trust is right for you, let’s take practical steps to get started. It’s about taking that first leap, but with a safety net, knowing you’ve got all the information you need.

First, gather all the information about your assets. This includes bank statements, property deeds, investment portfolios, and any other documentation that proves ownership. Having this information at hand will make the process smoother and more efficient.

Choosing the Right Trust for Your Family

Not all trusts are created equal, and choosing the right one is like picking the perfect outfit for an important occasion – it needs to fit just right. Consider the following when choosing your trust:

- The type of assets you want to protect.

- Your long-term financial goals for yourself and your family.

- The level of control you want to maintain over the assets.

For example, if you want to ensure that your children can access the funds at a certain age or milestone, a Discretionary Trust might be the way to go. On the other hand, if you want to retain some benefit from the assets, such as living in a property held in trust, a Life Interest Trust could be suitable.

Gathering Necessary Documentation

Documentation is the foundation of setting up your trust. You’ll need:

- Proof of identity for all parties involved (passport, driver’s license).

- Asset documentation (property deeds, bank statements, investment records).

- A list of beneficiaries and any specific terms you want to apply to their inheritance.

These documents will be used to draft the trust deed, the legal document that sets out the terms of your trust. Make sure you keep copies of everything and store them safely.

Seeking Professional Advice

Here’s where I can’t stress enough the importance of professional advice. It’s like navigating a ship through a storm; you want an experienced captain at the helm. A solicitor or financial advisor specializing in trusts can provide invaluable guidance, ensuring your trust is set up correctly and operates within the law.

They’ll help you:

- Understand the legal jargon and implications of your decisions.

- Identify any potential issues before they arise.

- Ensure your trust aligns with your financial goals and provides the intended protection for your assets.

Consider this professional advice not as an expense, but as an investment in your family’s future.

Realising Potential Risks and Addressing Them

With every financial strategy, there are risks, and a Family Asset Protection Trust is no exception. It’s essential to be aware of these risks so you can take steps to mitigate them. After all, forewarned is forearmed.

One potential risk is the accusation of ‘deliberate deprivation of assets.’ This is where it’s thought that you’ve moved assets into a trust to avoid them being used for care costs. If the authorities believe this to be the case, they may still assess these assets when determining your eligibility for financial assistance.

Deliberate Deprivation of Assets: A Risk Too High?

Setting up a trust too close to the time when you need care can be seen as deliberate deprivation. It’s like jumping out of a plane and throwing your parachute away just before you land – not a good idea.

Therefore, timing is crucial. Establish your trust well before you anticipate needing care. This foresight can demonstrate that your intentions were not to avoid care costs but to plan for your family’s future.

Additionally, the trust should be set up for legitimate reasons, such as estate planning or protecting assets for your beneficiaries, not solely to avoid care costs. Be transparent with your intentions, and document everything to show that the trust was established as part of a sound financial plan.

In the next section, we’ll tackle some frequently asked questions to further clarify any doubts you might have and ensure you’re fully informed to take the next steps in setting up your Family Asset Protection Trust.

Long-Term Impact on Eligibility for Means-Tested Support

It’s important to understand that placing assets into a trust can affect your eligibility for means-tested support. If you require state support for care, the local authority will assess your capital. If they determine that you have deliberately deprived yourself of assets to increase your eligibility for support, they may still count those assets as part of your capital. This is why it’s essential to establish a trust for the right reasons and at the right time, to avoid any implications that it was done solely to qualify for state support.

FAQs: Your Questions Answered

You’ve got questions, and it’s important that you get clear, straightforward answers. Here, we’ll address some of the most common queries surrounding Family Asset Protection Trusts to help you feel more confident about your decisions.

What Is the Difference Between a Family Asset Protection Trust and a Standard Will?

A Family Asset Protection Trust is a legal entity that holds your assets during your lifetime and specifies how they should be managed and distributed after your death. It offers more control and protection over your assets than a standard will. A will, on the other hand, is a document that outlines your wishes upon death but does not provide the same level of protection against future claims or care costs as a trust does.

How Can I Ensure My Trust is Compliant with UK Laws?

To ensure your trust complies with UK laws, it’s crucial to seek advice from a solicitor or financial advisor who specialises in trusts and estate planning. They will help you understand the legal requirements and ensure your trust is set up and administered correctly. Regular reviews and updates to your trust will also help maintain compliance with any changes in legislation.

Furthermore, it’s important to register your trust with HM Revenue and Customs if required, and to keep detailed records of all decisions and transactions related to the trust. This transparency can help demonstrate that the trust is being managed properly and for the right reasons.

Can I Access the Assets in the Trust for Emergency Situations?

Whether you can access the assets in the trust for emergency situations depends on the type of trust and the terms set out in the trust deed. Some trusts allow for this flexibility, while others may have more restrictions. It’s essential to discuss your needs and concerns with your advisor when setting up the trust to ensure it’s structured in a way that meets your requirements.

However, keep in mind that accessing assets in the trust can have implications on its effectiveness for asset protection and might affect your eligibility for means-tested support. It’s a delicate balance that needs careful consideration.

Is It Possible to Dissolve the Trust If Circumstances Change?

Yes, it is possible to dissolve a trust if circumstances change, but the process and implications will vary depending on the type of trust and the terms outlined in the trust deed. Dissolving a trust usually requires the agreement of all trustees and may also require the consent of the beneficiaries. It’s vital to have a clear dissolution process outlined in the trust deed to avoid complications later on.

How Frequently Should I Review and Update My Family Asset Protection Trust?

Your Family Asset Protection Trust should be reviewed regularly, at least every five years, or whenever there are significant changes in your family circumstances, financial situation, or legislation. This ensures that the trust continues to meet your needs and remains compliant with the law. Regular reviews are also an opportunity to reflect on the trust’s performance and make any necessary adjustments to the strategy.

By keeping your trust up to date, you’re not only maintaining its integrity but also reinforcing the security it provides to your family’s financial future. Always remember that your trust is a living document that should evolve with your life’s journey.